Ask any seasoned restaurateur what keeps their business alive, and chances are, it’s not just great food or a prime location. It’s knowing their restaurant P&L.

In a recent episode of Today’s Special, Chalu Chinese’s founder Vibhanshu Mishra said something that hit home:

“If you’re not tracking your numbers, you’re just running a passion project, not a business.”

Many restaurants fail not because of bad food or low footfall, but because of poor financial planning.

In this blog, we’ll break down the restaurant P&L in plain English, no accounting jargon, just real numbers, practical logic, and simple strategies you can start using right now.

Let’s decode the numbers that really matter.

What is a Restaurant Profit & Loss (P&L) Statement?

In plain English, your P&L statement tells you how much money your restaurant made, how much it spent, and what’s left over as profit.

If you don’t know how much of your sales go into rent, labour, or waste, or how much you need to sell just to survive. You’re in dangerous territory!

Take this simple formula:

Rent × 7 = Minimum monthly sales target.

If your rent is ₹22,000, you should be clocking at least ₹1.5 lakh a month. Anything less, and you’re bleeding money.

And that’s just one part of the game. You also need to keep:

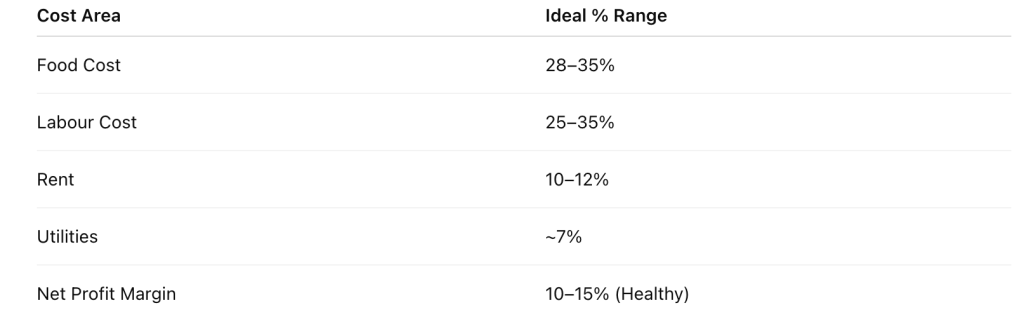

- Labour costs under 14–16% of your revenue

- Rent within 10–12%

- Utilities around 7%

None of this is guesswork. It’s what separates profitable restaurants from the ones barely scraping by.

This is where your Profit & Loss (P&L) statement becomes your best friend. Think of it as your financial report card.

It usually covers a specific time period—weekly, monthly, or quarterly—and helps you understand:

- Where your money is coming from

- Where it’s going

- Whether you’re actually making money or just staying busy

You must know about: What Are Anti-Profiteering (GST) Rules?

Why Understanding Your P&L is Crucial for Profitability

Many restaurants serve full houses but still operate on razor-thin margins. Why? Because they don’t truly understand their numbers.

When you know how to read and act on your P&L, you can:

- Spot problems before they become disasters

- Fix leaks in your profit bucket

- Make smarter, faster decisions

In short, it helps you run your restaurant like a business, not just a kitchen.

You must read about: Restaurant allocation

Breaking Down the Restaurant P&L Statement

Let’s simplify it. A restaurant P&L typically includes:

1. Total Revenue

Your income from:

- Food sales

- Beverage sales

- Other streams (delivery, catering, merchandise)

2. Cost of Goods Sold (COGS)

This is the cost of the raw materials:

- Food ingredients

- Beverages

- Packaging

3. Gross Profit

Your Revenue – COGS. This is what you’ve earned before operating expenses.

4. Operating Expenses

These are your fixed and variable expenses:

- Labor costs (salaries, benefits, overtime)

- Rent and utilities

- Marketing and tech tools

- Licenses, cleaning supplies, credit card fees

You must know about: What is a Loss Leader

5. Operating Income & Net Income

What’s left after all expenses—this is your actual profit (or loss). The number you really care about.

You must know about a sourcing strategy that could save you money!

How to Read a Restaurant P&L Effectively

Here’s the trick: don’t just look at the numbers—look for patterns.

Ask yourself:

- Are food costs rising? Why?

- Are sales increasing but profits shrinking?

- Are certain days or items bringing in more margin?

Make it a habit to review your P&L monthly (at least), and always compare it to previous periods.

How to Keep Costs Low

Managing Food Costs

This is where most restaurants bleed money. Here’s how to plug the leak:

- Calculate food cost percentage: (Food Cost ÷ Food Sales) × 100

Aim for 28–35%. - Do regular inventory checks: Weekly counts help track shrinkage and theft.

- Control waste and over-portioning: Train staff. Use portion tools. Track prep waste.

- Negotiate smart with suppliers: Don’t settle for the first quote. Prices change, so should your orders.

- Use tech to track real-time costs: Tools like MarketMan or xtraCHEF help you stay on top of fluctuations.

Controlling Labor Costs

Labour is one of your biggest expenses; manage it wisely.

- Know your labor cost percentage: Aim for 25–35%.

- Schedule smartly: Staff up for peak hours, not slow ones.

- Separate prep vs. service labor: Helps with better forecasting.

- Monitor in real-time: Daily tracking > end-of-month surprises.

You must read about: Labor Cost Percentage

Managing Overhead & Operating Expenses

- Rent and utilities: Negotiate lease terms. Use energy-efficient appliances.

- Marketing: Focus on what brings ROI (loyalty programs > flyers).

- Cut semi-variable costs: Credit card processing fees, cleaning supplies, linen services—these add up.

How to Keep Profits High

Boost Revenue without Burning Cash

- Menu Engineering: Highlight high-margin dishes. Nudge guests to order them (photos, placements, staff recommendations).

- Add revenue streams: Think catering, branded merchandise, special events, online ordering.

- Smart pricing: Price based on food cost + desired margin. Don’t copy competitors blindly.

Track the Right KPIs

Knowing your numbers is half the battle. Track:

Use Your P&L to Make Better Decisions

- Spot inefficiencies: Is your burger actually profitable?

- Adjust operations: Are you overstaffed on Mondays?

- Plan for seasons: What promos work best during monsoon vs. winter?

Turn One-Time Diners into Repeat Customers

Acquiring a new customer is expensive. But getting an existing one to return? That’s where your profits multiply.

Here’s how to turn diners into regulars:

- Collect data smartly: Use bills, QR codes, or feedback forms to gather customer info.

- Segment your audience: Identify loyalists, big spenders, or those who haven’t returned in a while.

- Send offers that feel personal: From birthday wishes to “we miss you” nudges—timing and relevance matter.

- Reward smartly: Not just for visits, but for spends, reviews, and referrals.

Reelo makes this effortless.

From tracking customer behaviour to sending automated campaigns and measuring repeat rates, Reelo helps you build real loyalty, without spreadsheets or guesswork.

Tools & Tips to Make It Easier

You don’t need to be a finance wizard, just use the right tools.

Recommended Tools

- MarketMan: Inventory and supplier management

- xtraCHEF: Tracks COGS, invoices, food costs

- Excel/Google Sheets: Use templates for recipe costing and daily tracking

- Reelo: To calculate the marketing spend across all your outlets

Best Practices

- Weekly inventory counts

- Daily sales vs. labor tracking

- Monthly deep dive into P&L

- Quarterly menu performance reviews

Common Questions from Fellow Restaurateurs

Ques. How detailed should my P&L be?

Ans. Detailed enough to spot what’s working and what’s not. Don’t drown in data, focus on the few key numbers that matter.

Ques. How do I reduce food waste?

Ans. Track prep waste, control portions, and make your staff part of the solution.

Ques. How do I split labour cost between prep and service?

Ans. Track hours separately, label each shift or use a POS-integrated timesheet system.

Ques. How often should I do inventory?

Ans. Weekly is ideal. Monthly at a minimum. The more frequent, the more accurate your food cost %.

Ques. How do I price dishes with ingredient costs changing all the time?

Ans. Build in a buffer margin and update pricing quarterly. Use templates to recalculate quickly.

Ques. What profit margins should I aim for?”

Ans. Gross profit: 60%+

Net profit: 10–15% is healthy. Anything below 5% = warning lights.

Final Thoughts

Your P&L isn’t just a document for your accountant, it’s a living, breathing map of your restaurant’s financial journey.

Check it often. Understand it deeply. Use it to guide every big decision, from staffing to menu planning.

Because the truth is, what you don’t measure, you can’t manage.

And in the restaurant business, every percentage point counts.

If you want to turn your P&L insights into smart, automated actions, like tracking repeat business, measuring campaign ROI, or plugging profit leaks. Reelo can help you do just that. Without the spreadsheets. Schedule a demo now!

BACK TO BLOG HOME

BACK TO BLOG HOME